Executive summary (Jan–Jul 2025)

Vietnam remains one of Asia’s most reliable sources of skilled and semi-skilled labor. In July 2025, Vietnam deployed 11,090 workers overseas (including 3,374 women). For the first seven months of 2025, the total reached 85,781 workers—28,991 of them women—achieving about 65.9% of the annual plan. The three leading destinations in this period were Japan (39,558), Taiwan (32,471), and South Korea (7,340), with additional placements across China, Singapore, Romania, Hungary, and other markets. These figures confirm a stable, predictable pipeline that employers can plan around.

Vietnam’s broader overseas workforce has grown into the hundreds of thousands spread across roughly forty countries and territories. That scale reflects consistent demand for dependable manpower in manufacturing, agriculture, construction, logistics, hospitality, caregiving, and related services.

Why host countries prefer Vietnamese workers

Employers consistently highlight three reasons:

- Discipline and trainability

Vietnamese workers adapt quickly to standard operating procedures, excel at repetitive precision tasks in factory environments, and show strong attendance and shift discipline. - Language and cultural readiness

Pre-departure training in language and workplace culture shortens the ramp-up period and improves on-site communication—especially valuable in systems such as Japan’s skills-based pathways, Taiwan’s industrial work permits, and Korea’s EPS. - Multi-year stability

Visa pathways in the main destination markets increasingly allow multi-year contracts with options to extend, helping employers stabilize headcount and control turnover.

2025 at a glance: facts and figures

Total deployments (Jan–Jul 2025): 85,781

Female workers (Jan–Jul 2025): 28,991 (~33.8%)

Top destinations (Jan–Jul 2025):

- Japan: 39,558 (≈46.1% of total)

- Taiwan: 32,471 (≈37.9% of total)

- South Korea: 7,340 (≈8.6% of total)

- Other markets combined: ≈6,412 (≈7.5% of total)

Monthly highlight (July 2025): 11,090 deployments (3,374 women)

Those shares underscore a clear pattern: the top three markets absorb the overwhelming majority of Vietnamese placements, led by manufacturing-heavy demand in Japan and Taiwan and steady EPS intake in South Korea.

Where Vietnamese workers go to work abroad: country snapshots

Japan (largest destination in 2025 YTD)

Deployments (Jan–Jul 2025): 39,558

- Who hires: food and general manufacturing, agriculture, construction, building maintenance/cleaning, hospitality, and nursing-care providers.

- What to know: Japan’s skills-based pathways (and the medium-term shift to a more mobility-friendly training framework) reward employers who invest in language and safety training and who plan multi-year rotations for retention.

Taiwan

- Deployments (Jan–Jul 2025): 32,471

- Who hires: industrial/manufacturing (electronics, metalwork, plastics, food processing) and household social-welfare employers (caregiving).

- What to know: Vietnam is the largest source of factory migrant workers in Taiwan; the island remains a mainstay for stable, shift-based production labor.

South Korea (EPS)

- Deployments (Jan–Jul 2025): 7,340

- Who hires: manufacturing, agriculture, fisheries (with some construction-related roles).

- What to know: The Employment Permit System (EPS) provides a structured, quota-based channel tailored to small and medium-sized employers facing persistent labor shortages.

Emerging Europe (Romania & Hungary) and selected hubs

- Who hires: automotive/electronics assembly, general manufacturing, construction, logistics/warehousing, and hospitality.

- What to know: Regulations and quotas are dynamic; plan early for permits and onboarding. These markets are attractive for employers seeking mid-scale crews and predictable ramp-up timelines.

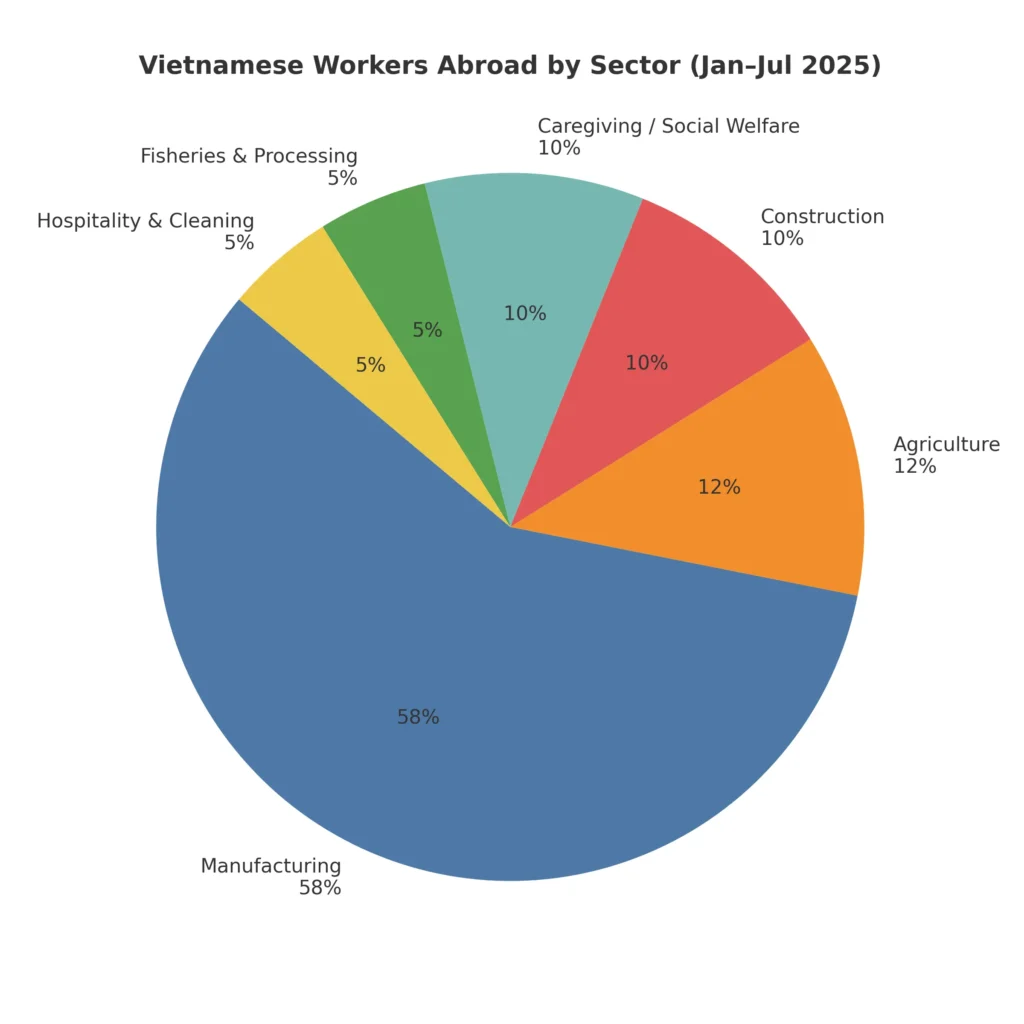

What Vietnamese workers do abroad: sector breakdown

Because each destination uses distinct visa categories, demand clusters into a few core sectors. Based on the current destination mix in 2025 YTD, the sector distribution is dominated by manufacturing, followed by agriculture, construction, caregiving, fisheries, and hospitality/cleaning.

Estimated sector split (Jan–Jul 2025):

The totals below convert the overall 85,781 deployments into a sector view using conservative, destination-weighted estimates. Actual shares vary by month and employer order, but the pattern—manufacturing first, then agriculture/construction/caregiving—remains stable across the top markets.

- Manufacturing: ~58% (≈49,750 workers)

Typical roles: electronics assembly, machinery/parts, plastics, food processing, quality control, packing. - Agriculture: ~12% (≈10,300 workers)

Typical roles: greenhouse work, crop cultivation and harvesting, horticulture, livestock support. - Construction: ~10% (≈8,600 workers)

Typical roles: finishing/tiling, steel fixing, carpentry, scaffolding, site logistics. - Caregiving / Household social welfare: ~10% (≈8,600 workers)

Typical roles: live-in or institutional caregiving, basic eldercare support, household assistance. - Fisheries & fish processing: ~5% (≈4,300 workers)

Typical roles: onshore processing, cold-chain packing, coastal and near-shore operations. - Hospitality & cleaning/building maintenance: ~5% (≈4,300 workers)

Typical roles: room attendants, kitchen assistants, janitorial crews, facility upkeep.

This distribution is consistent with the hiring profile of Japan and Taiwan (factory-led), the sector allocations in Korea’s EPS (manufacturing/agri/fishery), and the role composition in Eastern Europe (manufacturing and construction).

Gender composition: how women participate

- Women deployed (Jan–Jul 2025): 28,991 (~one-third of total).

- Where women work: caregiving and services show higher female shares; light manufacturing also attracts many female applicants due to stable shift work, predictable schedules, and clean-room or line-based environments.

- What this means for employers: to attract and retain female workers, emphasize safe dormitory standards, access to community networks, predictable shifts, and reasonable overtime policies. These practical supports reduce churn and enhance productivity.

Advantages for employers in the top sectors

Manufacturing (electronics, machinery, food)

- Predictable throughput from workers accustomed to SOPs and quality checks.

- Quick scale-up for seasonal peaks via shift-based rotations.

- Cost-effective training investment carries over to multi-year extensions.

Agriculture

- Greenhouse and horticulture operations benefit from crews familiar with repetitive, timed tasks.

- Rotations can align with harvest calendars to minimize idle payroll.

Construction

- Reliable finishing trades (tiling, plastering, carpentry) and site logistics.

- Crew leaders can be promoted from returning workers to stabilize quality.

Caregiving

- Strong human-touch orientation supported by practical pre-departure training.

- Employers who provide structured onboarding and language basics see faster integration into care routines.

Fisheries & processing

- Cold-chain discipline and line-speed consistency lend to productivity gains.

- Safety refreshers and proper PPE management keep absenteeism low.

Hospitality & cleaning

- High standards in cleanliness and service can be achieved quickly with clear checklists and supervision.

- Multi-site staffing models help hotels and facility managers cover peak occupancy.

Compliance and planning checklist for recruiters and employers

- Pick the right market–visa fit

Match each role to the best route (e.g., skills-based tracks in Japan, industrial vs. household categories in Taiwan, EPS allotments in Korea). Each framework has specific language, testing, and employer obligations. - Define contract terms and rotations

Decide on 1–3-year contracts (with possible extensions), then design on/off rotations to cover demand surges. Clarify overtime and rest-day rules up front. - Invest in pre-departure preparation

Language fundamentals, workplace culture, safety training, and grievance channels reduce early attrition, lower onboarding costs, and improve audit readiness. - Standardize documentation

Use templated contracts and transparent cost breakdowns. Maintain audit-ready records for inspections and renewals. - Provide decent accommodation and welfare

Safe dorms, transportation, and access to basic healthcare and social activities help retention—especially for female workers and first-time migrants. - Plan renewals early

Start extension paperwork and skill-up plans months in advance. Returning workers are a powerful lever for productivity and crew leadership.

2025–2026 outlook: what to expect

- Japan: Skills-based pathways should continue to absorb large numbers of Vietnamese workers, particularly in food and general manufacturing, agriculture, cleaning/building maintenance, hospitality, and care support. Ongoing policy modernization points to clearer career ladders and, in time, improved job mobility—good news for long-term workforce planning.

- Taiwan: Manufacturing demand remains the anchor, with incremental improvements in caregiver frameworks. Employers benefit from predictable shift systems and the availability of intermediate-skilled pathways for longer stays in certain roles.

- South Korea: EPS hiring is expected to remain steady across manufacturing, agriculture, and fisheries, where small and medium-sized enterprises continue to face structural labor shortages.

- Emerging Europe: Romania and Hungary keep drawing Vietnamese workers into manufacturing, construction, and logistics. Since employer eligibility and quotas can change, early planning and strong documentation practices are essential.

Practical data table (Jan–Jul 2025)

| Item | Value |

|---|---|

| Total deployments (YTD) | 85,781 |

| Women deployed (YTD) | 28,991 |

| Share of annual plan achieved | ~65.9% |

| Japan | 39,558 |

| Taiwan | 32,471 |

| South Korea | 7,340 |

| Other markets | ~6,412 |

Estimated sector split from total 85,781 (illustrative, destination-weighted):

| Sector | Share | Approx. workers |

|---|---|---|

| Manufacturing | ~58% | ~49,750 |

| Agriculture | ~12% | ~10,300 |

| Construction | ~10% | ~8,600 |

| Caregiving / Social welfare | ~10% | ~8,600 |

| Fisheries & processing | ~5% | ~4,300 |

| Hospitality & cleaning | ~5% | ~4,300 |

Note: Sector figures are rounded estimates consistent with the 2025 destination mix and common visa allocations; actual monthly shares vary by employer orders and quotas.

How Firstman helps global employers hire Vietnamese workers

FIRSTMAN VIETNAM RECRUITMENT, MANPOWER SUPPLY & IMMIGRATION SERVICES AGENCY supports end-to-end hiring for manufacturing, food processing, agriculture, construction, logistics, hospitality, caregiving, and more—across Japan, Taiwan, South Korea, Romania, Hungary, and additional destinations.

What you get:

- Market & visa mapping for each role (fastest compliant route)

- Source–screen–skill pipeline with language and safety training

- Transparent paperwork and employer-of-record coordination where applicable

- On-time deployment with clear milestone tracking and reporting

- Retention support: accommodation standards, welfare guidance, and planning for contract extensions/returns

Take the Next Step with Firstman Vietnam

Are you planning to hire skilled and reliable Vietnamese workers to go abroad for your business?

Let FIRSTMAN VIETNAM RECRUITMENT, MANPOWER SUPPLY & IMMIGRATION SERVICES AGENCY be your trusted partner. We specialize in sourcing, training, and deploying Vietnamese manpower—helping global employers fill workforce gaps with speed and compliance.

📞 Hotline / WhatsApp: +84 944 578 111

📧 Email: admin@firstman.vn

🏢 Hanoi Office: 36 Lê Đức Thọ, Nam Từ Liêm, Hà Nội

🏢 Ho Chi Minh City Office: 725/21 Trường Chinh, Tây Thạnh, Tân Phú, TP. Hồ Chí Minh

🌐 Website: www.firstman.asia

👉 Contact us today for a free consultation and start building your overseas workforce with Firstman!

Sources

- DOLAB 2025 YTD deployments, female share, and top-country counts; annual plan 130,000. vietnam.vn

- Monthly breakdown for July 2025; additional markets active. vietnam.vn

- Total Vietnamese abroad (~800k in 40+ markets), 2024 deployments (~158k), annual remittances (~US$5b). VnEconomy

- Japan: Vietnamese as largest foreign labor group (518,364 in Oct 2023). ISEAS-Yusof Ishak Institute

- Japan SSW surge, Vietnamese share & sectors. 行政書士法人IMSThe Japan Timeside.go.jp

- Japan policy reform: TITP → ESD by 2027 (legislation & analysis). ICLG Business Reportsnippon.comAP News

- Taiwan: industrial vs household social-welfare migrants by nationality (Vietnam leads factories). ECOI.net

- Taiwan caregiver/intermediate-skilled policy context. Controller and Auditor General

- Hungary/Eastern Europe: 2024–2025 regulatory changes impacting hiring. FragomenFakhoury Law Group, PC